In that case the money could be sent back to the IRS and youd likely be issued a refund in the form of a paper check. The bank will reject the refund and send it back to the IRS.

Irs Announces 2014 Tax Brackets Standard Deduction Amounts And More Tax Brackets Income Tax Brackets Federal Income Tax

The check was issued and returned to the IRS how do i get it.

Irs how to fix wrong bank account number. But watch out as occasionally banks will inadvertently accept refund checks even if the name on the account does not match the name on the tax return says Allman. If it has been accepted and the destination bank. Then the IRS will issue a paper check and mail it to the address you put on your tax return.

If either the bank routing number or account number is incorrect on an e-filed return If it has not been accepted contact the IRS. The bank will reject the refund and send it back to the IRS. You incorrectly enter an account or routing number that belongs to someone else and your designated financial institution accepts the deposit.

If your typical method of payment is a Direct Express card the Get My Payment tool will show a bank account number thats associated with that. If the IRS already completed the refund transaction to bank account but the money is not deposited in the bank account you can submit Form 3911 which is a Taxpayer Statement Regarding Refund to request a trace. If your bank account number is incorrect and you are due a refund call 1- 8008291954.

If your address has changed you need to notify the IRS to ensure you receive any IRS refunds or correspondence. Generally the banking institution associated with the routing number listed on your tax return will return the funds to the IRS if the name on the account does not match the account number on the. The IRS will then print out a check and send it to the address listed on the return.

If you were making an electronic tax payment call 1-888-353-4537 to correct the error. See the last solution bullet below. If you realize just after submission that youve put the wrong number on your tax return direct deposit call the IRS at 800-829-1040 Monday through Friday from 7 am.

And ask them to stop the direct deposit. According to the IRS you cannot request a deposit of your refund to an account that is not in your name. The IRS will attempt to correct the error but you may have to follow up with the bank if your refund was deposited into another bank account.

Gather all of the information you can about your return. I thought this meant you are expecting a refund by direct deposit and put down the wrong bank number. This is the IRS.

See IRS and Tax Related Contact Phone Numbers in Related Links below. If this is the case contact the IRS at 1-800-829-1040 to let them know you accidentally omitted a number from your account number. Look at the tax refund direct deposit information to see whether you entered the correct bank account number and routing number.

The IRS says that if it sends your third stimulus check to the bank account it has on file for you and that account has been closed or the bank account details are otherwise invalid the bank. The IRS offers a portal where you can update direct deposit information which is what many people are now trying to do. If it is accepted however it is too late to change it.

Meantime Jones hopes the wrong account numbers will be corrected so she and everyone else can get their check. If youre lucky enough to catch the error before your return posts to the IRS system you might be able to stop the deposit. In most cases a bank account will reject a direct deposit that doesnt match the name on the account.

Banking information for refund is wrong. In most cases this process happens fairly quickly but please contact the IRS directly at 800-829-1040 to. If the SSN and last name of the account holder does not match the IRS records the bank should reject the transaction.

If it is accepted however it is too late to change it. You can make this request by calling the IRS at 800-829-1040. Then the IRS will issue a paper check and mail it to the address you put on your tax return.

If you entered incorrect banking information for your refund you can change it if your return is rejected. The IRS will issue a paper check for the amount of that deposit once it is received. Forgotten Digit in Your Account Number Step 1 If the account number you gave the IRS is missing a digit it will fail to pass a simple validation check with the bureau.

You must work directly with the respective financial institution to recover your funds. There are several ways to tell us your address has changed. If you entered incorrect banking information for your refund you can change it if your return is rejected.

For these circumstances call the IRS at 800-829-1040 Monday - Friday 7 am. Call the IRS Refund Hotline at 1-800-829-1040. Got it so you are expecting a refund by check but it was issued to the wrong bank number so the bank return it to the IRS and now you need it re-issued.

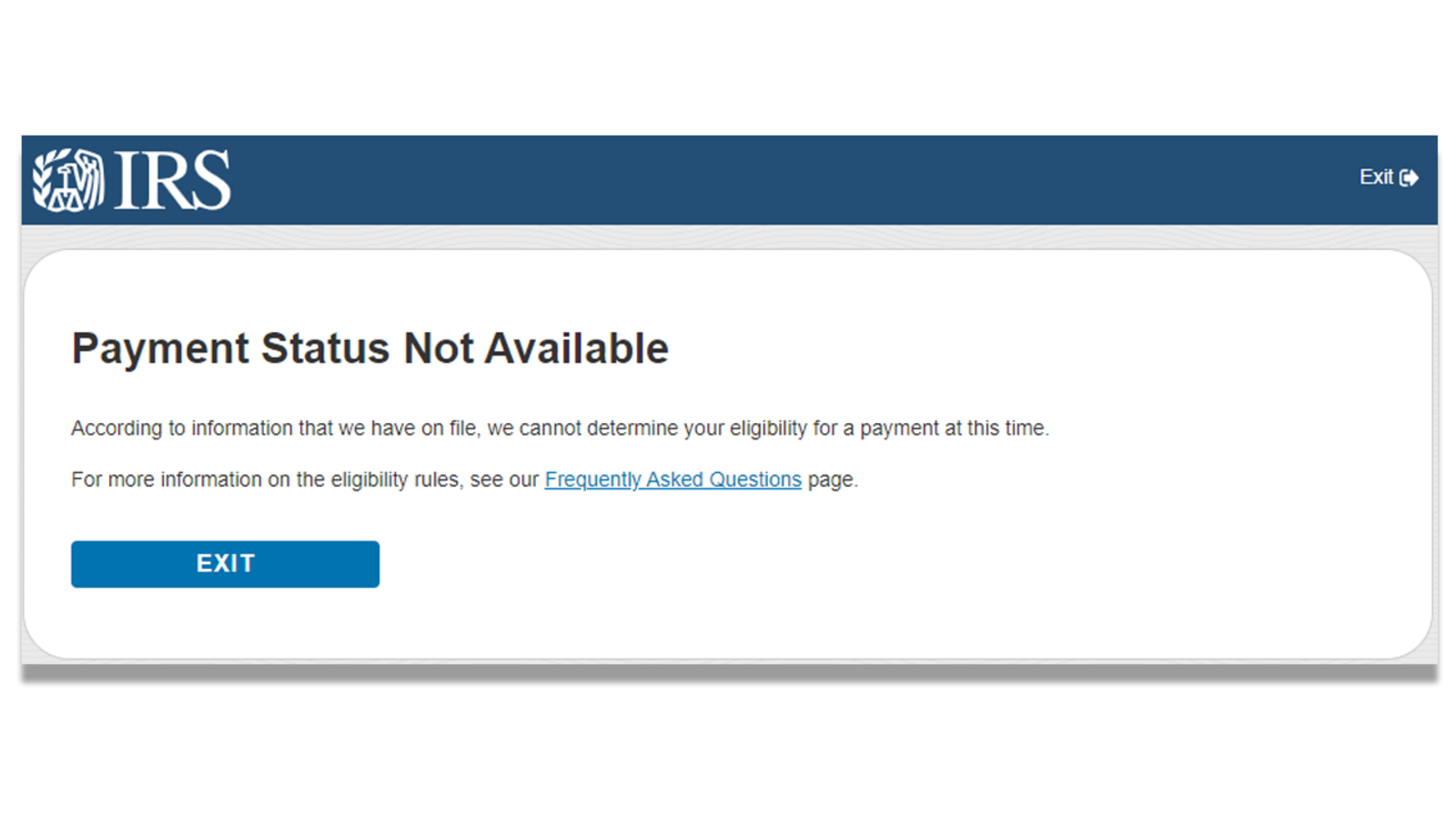

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc30 Fresno

People Say They Can T Find Their Stimulus Check Using The Irs Payment Tracker Krdo

Stimulus Check Problems What To Do If Check Goes Into Wrong Account Irs Get My Payment Portal Shows Error Abc7 Los Angeles

Irs Says You Can Now Check The Status Of Your Stimulus Check With Get My Payment Tool

Us Stimulus Check What To Do If I Receive Irs Money By Mistake As Com

How To Set Up Direct Deposit With Irs

How To Set Up Direct Deposit With Irs

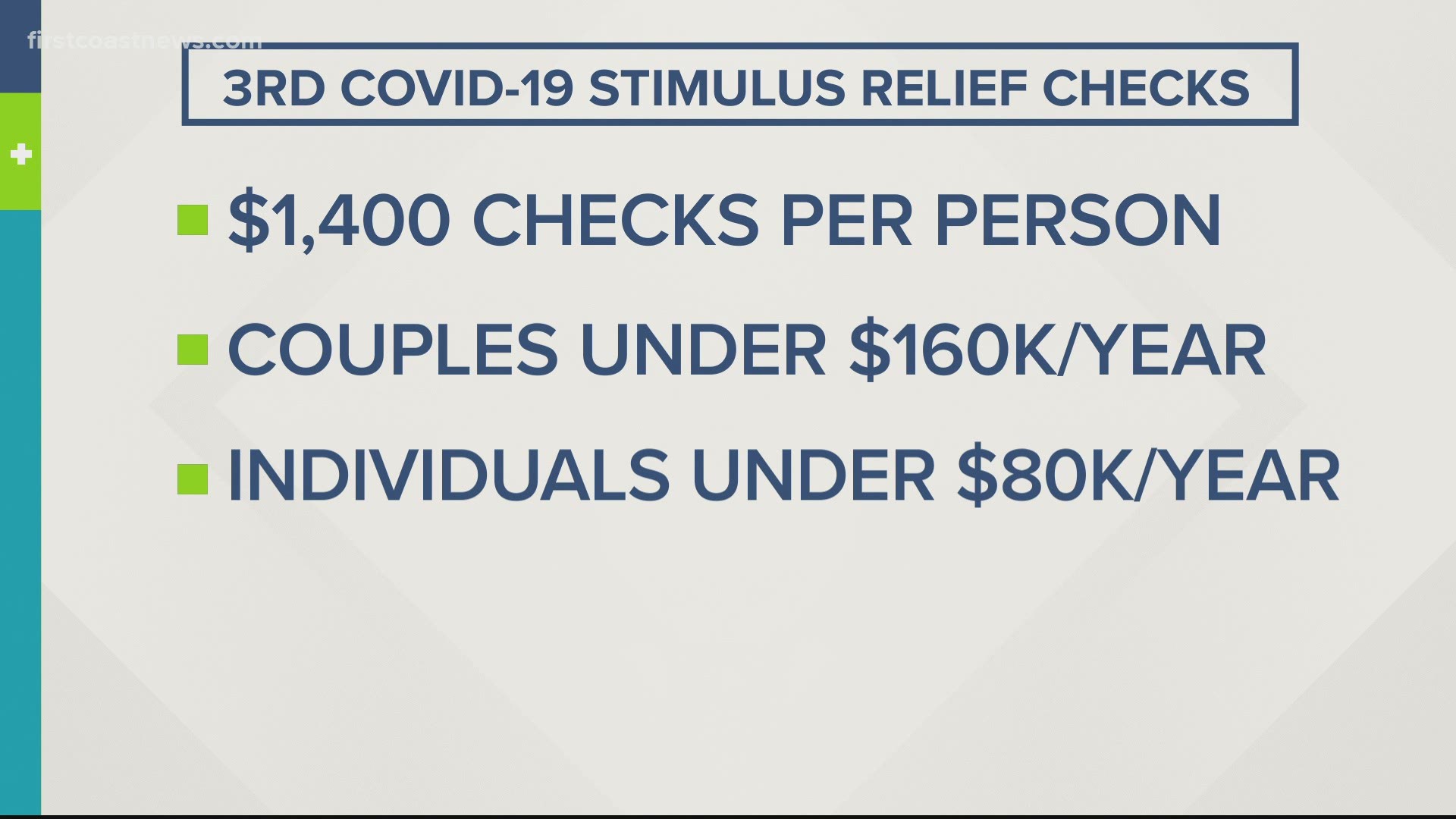

Stimulus Checks Sent To Wrong Bank Accounts For Some Americans Checking Irs Get My Payment Tool Firstcoastnews Com

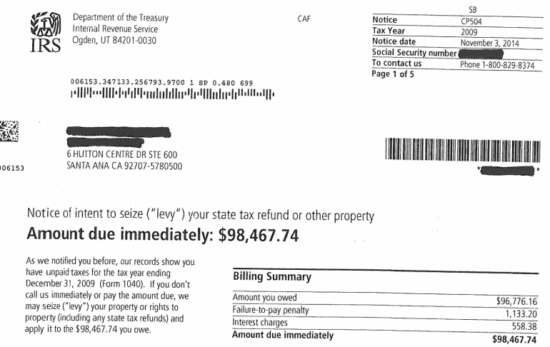

Irs Tax Notices Explained Landmark Tax Group

How To Set Up Direct Deposit With Irs

Received A Notice From The Irs Or Department Of Revenue Here S What You Need To Do Sacco Tax

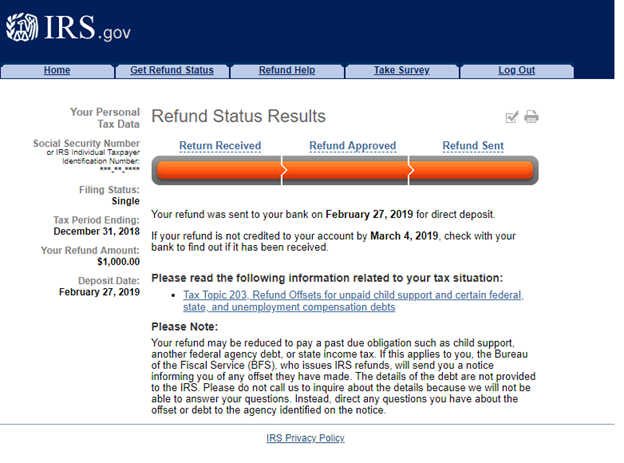

Why Was The Refund Amount Deposited To My Account Different From The Irs Where S My Refund Link Support

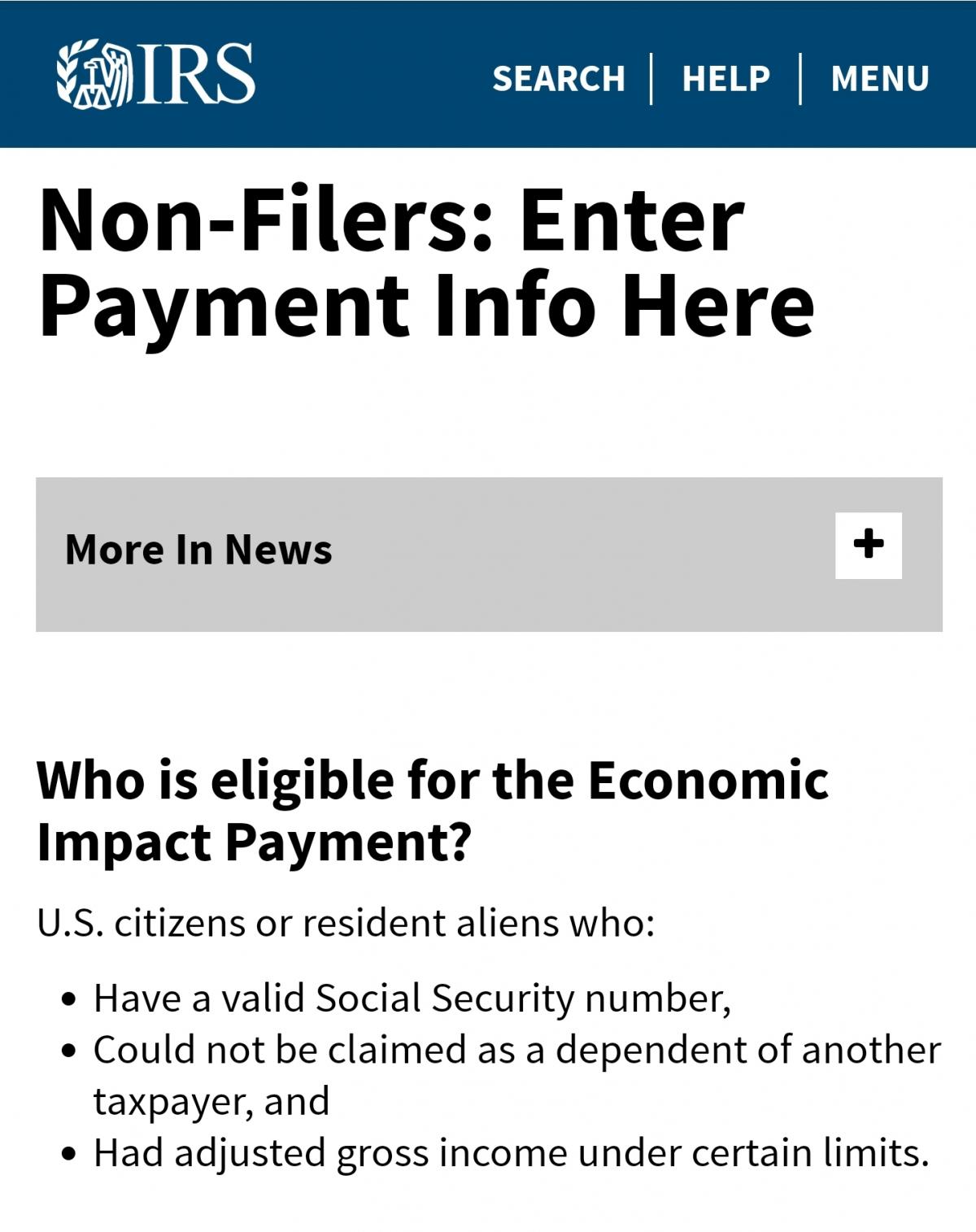

How Non Filers Irs Can Receive Stimulus Check City Of Miami Springs Florida Official Website

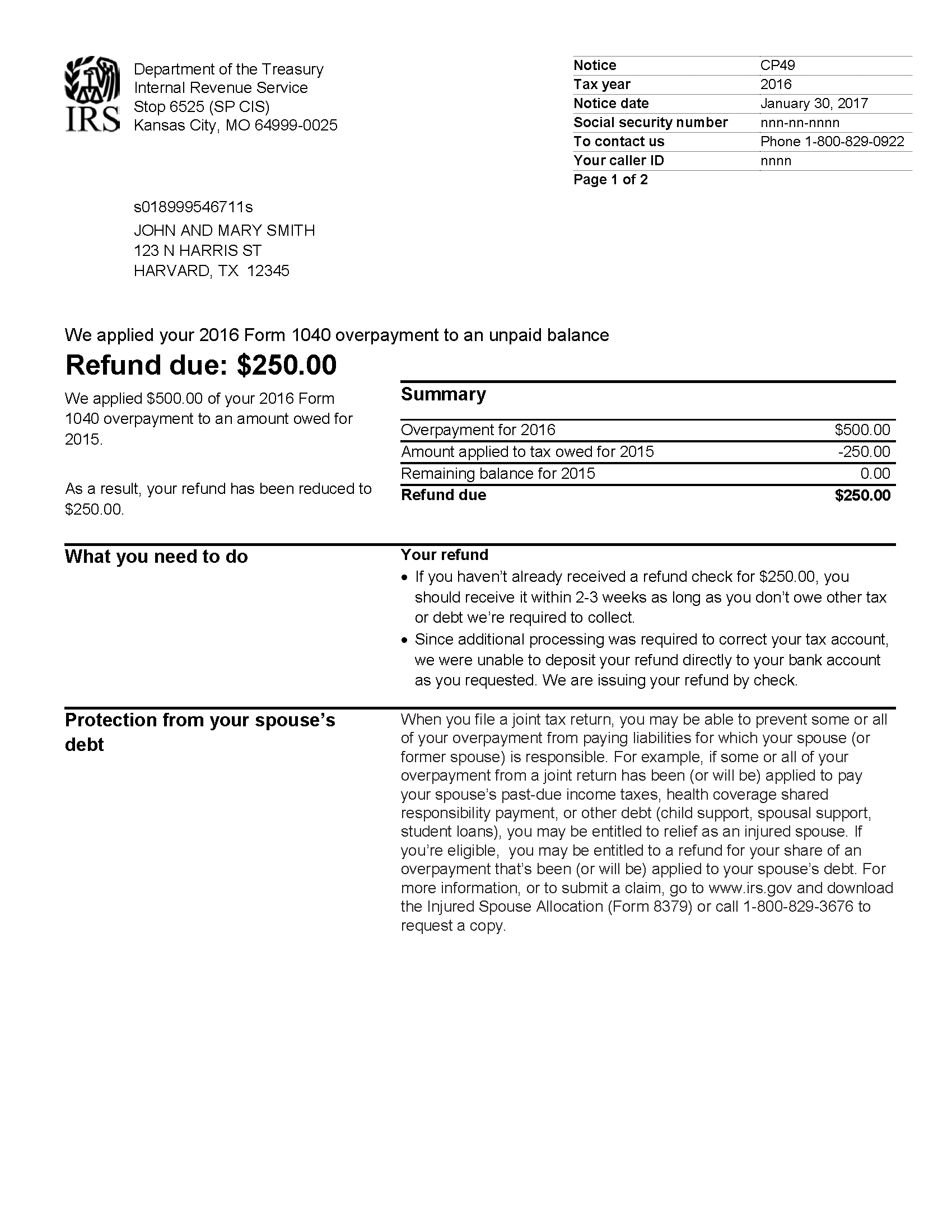

Irs Notice Cp49 Overpayment Applied To Taxes Owed H R Block

How Do I Fix My Tax Return If I Messed Up On My Account Number To Be Direct Deposited The Classroom Synonym Budgeting Money Tax Return Tax Refund

How To Set Up Direct Deposit With Irs

No Stimulus Check Irs Tells Non Filers To Check The Mail To Find Out How To Claim One

3rd Stimulus Check What Is Irs Treas 310 Marca

Change Your Business Name With The Irs Harvard Business Services