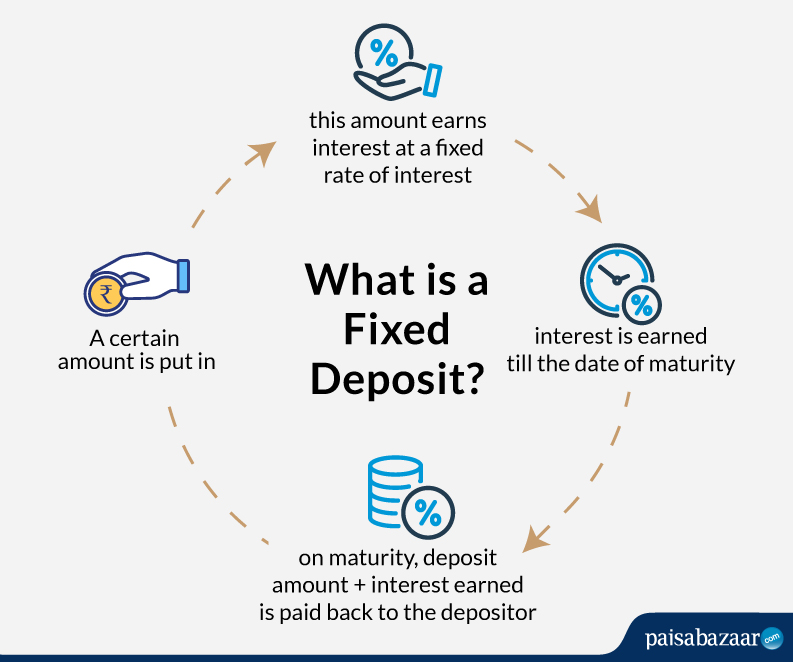

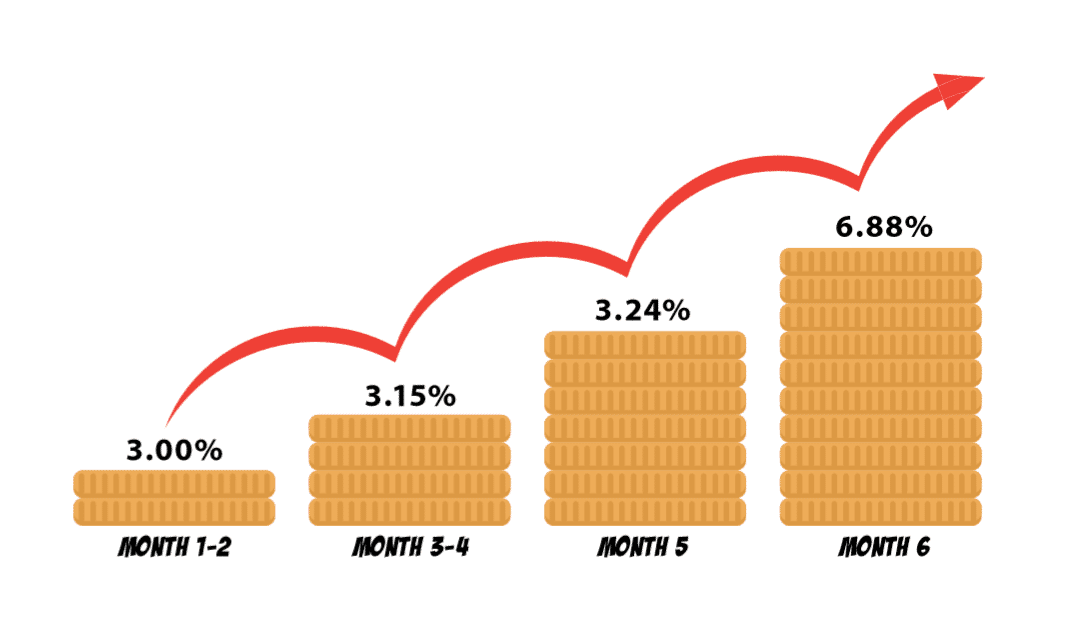

Therefore if a person invested fixed deposit for 3 months then the rate of interest will be levied on the amount for an interest rate supporting 3 months. A fixed deposit FD allows you to invest a one-off sum of money for a chosen period tenure to earn a fixed rate of interest.

Additional Deposit Form Bank Of India The History Of Additional Deposit Form Bank Of India Yes Bank Bank Of India Bank

Written by iMoney Editorial.

How does fixed deposit work in india. Until the tenure ends a fixed deposit usually earns a higher interest rate than a regular savings account. The principal amount that is deposited earns. In the event of the fixed deposit being closed before completing the original term interest will be paid at the rate applicable on the date of deposit for the period for which the deposit has remained with the bank.

This may be necessary if you urgently require the funds or if. 1000 and interest in excess thereof will be refunded to the depositor through RTGS NEFT ECS Direct Credit. In return the investor agrees not to withdraw or access their funds for a fixed period of time.

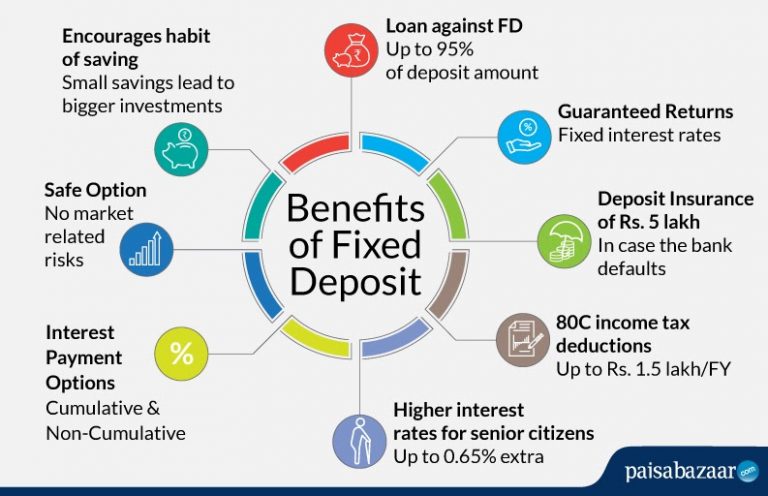

When investing in fixed deposits you lock away your funds for a fixed period and the principal sum deposited helps you earn interest on a cumulative basis. The rate of interest on your deposit depends on the tenor you choose and the frequency of interest payouts. A Flexi-Fixed deposit is a special kind of deposit offered by Indian banks and in other countries as well.

You can deposit a sum of money called principal with the bank for a fixed time period tenure. The deposit will earn interest during this period. It is quite popular form of investing in India.

How does Fixed Deposit work. In a fixed deposit interest is only paid at the very end of the investment period. Renewal of Fixed Deposit will be done in multiples of Rs.

In a fixed deposit your money is locked away for a fixed period of time in a bank. A fixed deposit is a safe and easy investment that requires a one-time deposit only. Renewal of the Deposits shall be subject to Scheme of Deposit and terms conditions thereof prevailing on the date of renewal and as per the discretion of the Company.

Fixed Deposits are bank deposits for a fixed or specified period chosen by investor or depositor at a fixed rate of interest. The bank considers the income earned by the depositor till the end of a financial year and then deducts the tax on it. Every individual aims to save a certain amount of money but end up spending it all.

The nature of this investment is very secure and they earn interest as per the interest rate they carry. How Do Fixed Deposits Work. The deposit can be made for a specific period ranging from 7.

The depositor opting for a Flexi FD is able to avail of both the liquidity of savings and current accounts and the high returns of fixed deposits. All fixed deposit accounts are calculated with a rate of interest added to the account on the basis of the entire work structure of the fixed deposit account. This means that after every specific time interval the interest earned on your fixed deposits gets added to your principal amount which results in incremental growth of interest earned after every specific interval.

This could lead to. Saving money is easier said than done. The FD formula for calculation of interest is listed below.

As the name suggests fixed deposit offers fixed returns on the investments. Fixed deposit is a traditional investment tool preferred by investors who are looking for a secure investment option and regular income flow. At the end of it you will get your deposit back along with interest.

Fixed Deposits are an easy way to earn returns from funds that are lying idle. Fixed Deposit FD is a reliable investment tool for preserving and growing savings. It is formed by combining a demand deposit and a fixed deposit.

Fixed deposits are financial provisions that are offered by banks and NBFCs where you can deposit a lump sum of money to yield a higher rate of interest as compared to your savings account. Fixed Deposit FD is an investment product which allows you to invest a lump of money for a fixed time period and at a fixed rate of interest. For every individual whether salaried or self employed saving money proves to be an essential part of ones life.

A fixed deposit or FD is a type of bank account that promises the investor a fixed rate of interest. A Fixed Deposit is a type of an account opened with a bank where an assured rate of interest is paid for keeping the funds for a particular period. Breaking a fixed deposit means withdrawing the money before the maturity expires.

How does a fixed deposit work. The deposit may be subject to a penal rate of interest as prescribed by the bank on the date of. Unlike dividends interest received from fixed deposits is taxable in the hands of the receiver and hence tax is deducted by the bank after a threshold.

What Is Fixed Deposit Fd Definition Advantages Of Fd Account

Interest Rates Pattern Of Bank Deposits In India 2012 To 2018 Investing Bank Interest Investment In India

Fixed Deposit And Interest Rates

What Has Been The Average Interest Rate On A Fixed Deposit For The Past 5 Years In India Quora

Introducing Fixed Deposits On Etmoney Investment App Investing Investment Portfolio

Benefits Of Fixed Deposits Fds In India

All You Need To Know Before You Invest In Fixed Deposits Mymoneysage Blog

Central Bank Of India Fixed Deposit Online

Bt Insight Should You Wait For Fd Rates To Go Up Or Lock In Your Money Now

Everything You Need To Know About Fixed Deposits

Allahabad Bank Fixed Deposit Interest Rate Https Banksguide In Allahabad Bank Fixed Deposit Interest Rate Interest Rates Deposit Best Interest Rates

Benefits Of Fixed Deposits Fds In India

4 Benefits Of Adding Fixed Deposits To Your Portfolio Deposit Wealth Creation Bank Rate

Debunking A Few Fixed Deposit Myths Deposit Interest Rates How To Raise Money

7 Awesome Reasons To Invest In Fixed Deposit Investing Deposit Finance

Difference Between Nre And Nro Fds Fixed Deposit